I’m feeling a little like I’ll never catch up on my to-do list items, and so the blog seems to always be the things to get left behind… But it’s time for another financial update and review of our financial goals for 2017, so I have pulled together enough for at least this post… So here’ goes…

#1 – Emergency Fund

Another month of successfully avoiding pulling anything from the human emergency fund. It is still sitting at the happy $10,000 mark.

November was another month of just regular pet expenses, so we were able to add a little to the pet emergency fund. I’m not sure we will get to the $5000 before the end of the year, but it is still moving in the right direction, so I’ll count that as a positive.

Human Emergency Fund = $10,000

Pet Emergency Fund = $3720 (+$225)

#2 – Planned Spending

It is hard to keep track of these goals as we spend some of the money in the funds each month as well as try to add to them… But, I’m pretty sure we didn’t add anything to any of these goals this month. And I have a sneaking suspicion that we won’t add much to them in December either, but such is life.

- Travel #1: $3650 / $3000 >> We spent more than we had planned…

Income Tax: $0 / $400>> Turns out we both got a refund this year!- More Home Renos: $9000 / $35,000

- Other Travel: $5000 / $5000 >> Done!

- Other Savings (aka Baby Fund): $10,000 / $16,000

- *Education Fund: $3800 / $7500

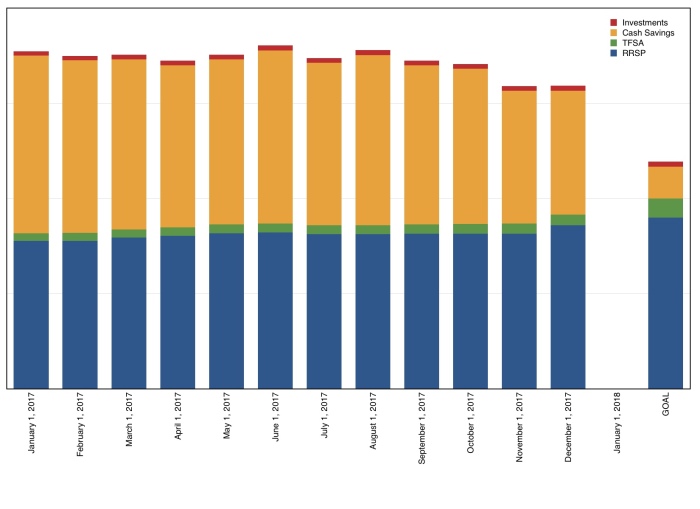

#3 – Net Worth

Okay, I have finally dragged out the desktop computer and updated my net worth spreadsheet. (Okay, fine, I didn’t drag the computer out of the basement, my husband did, but the end result is still that I was able to finally update my net worth spreadsheet.)

As expected, our net worth is on a downward trend as we spend all our home renovation savings.

Net Worth: The goal is a decrease of 32%. You can see that we haven’t quite got there yet. This is both good and bad… Good that perhaps we won’t lose so much net worth to the renovations, but bad because it is a sign that the renovations are taking longer than I had anticipated…

RRSP: The goal is an increase of 15%. We are up by over 10%, but I don’t think we will get that last 5% increase in one month.

TFSA: The goal is an increase of 155%, which sounds crazy, but remember that small numbers can increase in percentage quickly… So far we have had an increase of about 45%, which is great, but, again, I don’t think we will get the remaining increase in the last month of the year.

Cash: The goal is a decrease of 82% because of all the renovation spending. We have decreased by over 32%, but we had some changes in priorities during the past year that have made us want to save up some more. I am totally happy if we don’t make this goal.

Taxable Investments: The goal is an increase of 16%. We are actually up 19%, so this goal has been met and surpassed. I’d like to say it was because of something we did, but it is totally out of our control, and based completely on market returns and values. I’m not going to complain though. If these investments just sit here and grow, that is exactly what we want them to do.

#4 – Monthly Spending below $8000

After a couple months of success, we went over budget in November again. I blame some car expenses (my husband got new brakes for his car – a totally legit and worthwhile expense) and just the timing of some of the bills getting paid. (It might actually help keep December expenses down a little… or maybe that’s why October was so successful… ) In any case, I’m not going to stress about it because I don’t feel like I have the energy… I think renovation fatigue is a thing… 6 months of living through renovations with out a functional kitchen is actually quite trying…

How was November for your finances?