It has been 1 year since we re-financed our mortgage. At the time, I posted two posts about it; the first was going over my to-do list for the renewal, and the second was all the details of our new mortgage.

While I am still waiting for the renovations to be actually completed, I am happy with our decision to use money out of the equity in our home for that purpose, even if it goes against a lot of traditional personal finance advice. And, I am still happy with our decision to not make paying off the mortgage a priority at this point, since we have a nice low fixed rate of 2.34% for four more years. Since rates have already started to increase, we will have to revisit that decision when we go to renew in four years, but until then we will probably just let it go on auto-pilot. That being said, I wouldn’t be a personal finance geek if I didn’t play with numbers in a spreadsheet… And so, of course, I have done that with our mortgage…

How much interest do we pay each month?

A while back, someone posted something about their mortgage payment where they calculated how much of their monthly payment is going to principle, vs how much is going to interest… (I’m sorry, but I can’t remember where I read it, so if you have posted about this, let me know in the comments and I can link to your post.) I found it an interesting idea, so I thought I’d figure it out for our payments too. The issue is, of course, that every month that passes, the amount of principle goes down, so the amount of interest charged goes down, so the percentages change… That meant I needed to do the calculation a few times…

The initial payment distribution when we started the mortgage was 41% interest and 59% principle. We have now moved in to the phase where we are paying 40% interest and 60% principle. Based on my rough calculations (more along the lines of rough estimates, instead of calculations), when our mortgage is up for renewal in four years, we will have made it to a 34% interest and 66% principal with our biweekly payments.

| Balance | Interest Portion of Payment | Principle Portion of Payment |

| $625,000 | 41% | 59% |

| $604,000 | 40% | 60% |

| $515,000 | 34% | 66% |

What would the numbers look like if…. ?

We all like to play the “what if” game for various topics or scenarios. Sometimes it is productive, like planning for potential emergencies, or for future events. Sometimes it is super counter-productive, and can cause people to get paranoid of things that are not likely to happen… But today I’m going to play the “what if” game with our mortgage and look at a few scenarios.

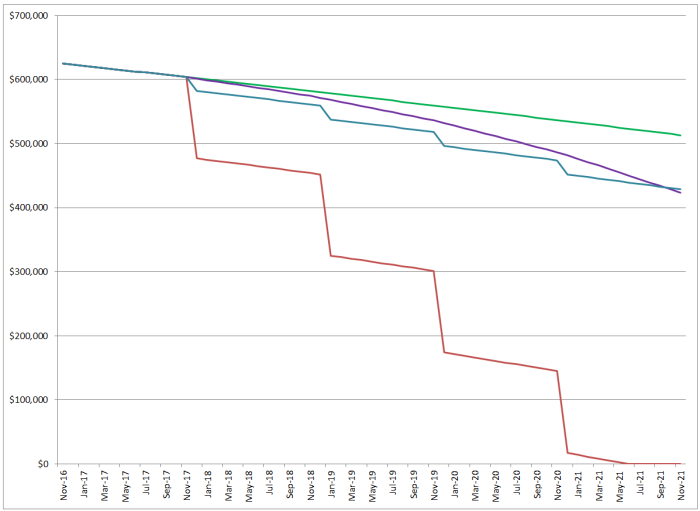

Scenario #1: Nothing changes – literally. Our mortgage rate and payment remain the same forever… This has us with a mortgage of $515,000 at the end of the 5 year term. I could forecast the rest of the 20-ish years left in the amortization period, but I’m not going to do that today… That’s too much work and probably not realistic.

Scenario #2: We take advantage of the allowable 20% increase to our biweekly payments each year… This has us with a mortgage of $423,000 at the end of the 5 year term.

Scenario #3: Instead of the increase in biweekly payments, we make use of the allowable 20% lump sum payment each year… This one isn’t very realistic… I doubt we will get an extra $125,000 each year to put on the mortgage… But, it would mean that we could pay off the mortgage completely by the end of the 5 year term. Wouldn’t that be amazing?!?

Scenario #4: The most realistic of the non-status-quo scenarios is taking partial advantage of the lump sum payments. If we were to put an extra $20,000 on the mortgage per year (might not totally be possible, but more likely than $125,000), we could end up with a mortgage of about $430,000 at the end of the 5 year term.

What sort of “what if” games do you play? Have you done something similar with your mortgage?

I play so many what if games with ours! We are mostly keeping it for ownership titling reasons right now but we could technically pay it off by selling some stocks right now or with cash flow in May or June, which would be really cool. We have an adjustable rate mortgage that has been at 2.5% since early 2013 and it will reset in early 2018 after the initial five year period. It’s looking like it’ll change to 4.125% and then it will adjust every year going forward. My husband finds it a bit confusing and annoying with the interest rate changes so perhaps we will pay it off sooner rather than later.

LikeLiked by 2 people

Yeah, that increase from 2.5% to 4.125% might be good motivation to pay it off… But then again, if you can get 6% or 7% return on investments, probably better to just keep it?

LikeLike

I play with my mortgage every now and then 😉 I have payed extra for years, which have gotten me to where I could pay it off today if I wanted to… But my interest is pretty low, so instead of paying it down I’ve invested that money in different “mutual funds” which is currently doing really nice, with a return of way more than what my interest cost me every month on the mortgage 😀

LikeLiked by 1 person

That’s great that you have paid extra and are in that type of situation. That’s the common reason why people have been delaying paying off their mortgages these days… Interest rates are low, so it makes more sense to invest and get a better return on your money.

LikeLiked by 1 person

I, too, play with my mortgage. I typically figure out how quickly I’d pay it off if the whole amount of the mortgage (principle, interest and taxes/insurance) went to principle. I also figure out how quickly the principle would go down if I put in various dollar amounts a month. My main goal now though is to pay it off by my early retirement target date, which is 10-11 years away. I’m pretty sure I can do it!

LikeLiked by 1 person

I’m sure you’ll be able to meet your goal. It’s fun to play with the different scenarios though, eh? My mortgage is so big though that the amounts to make a big difference are always so disheartening to calculate… I’m definitely on the slow and steady train at the moment.

LikeLike