I’ve been away for work for a while (still am actually) and haven’t really been too active on the blog… Have you missed me? And now it’s already a few days in to October, so I better get this September spending review and October budget figured out…

September marks the six month mark of using YNAB software budget. I’ve written about how much I love YNAB many times, but I have had a lot of fun comparing my monthly spending over the past six months with one of the reports that they have. Take a look:

Can you tell what month we got our roof done? And what month we had our wedding? But what I’m most proud of is how low September is! Take a look at how low that spending is! I know that part of is was just a fluke and the fact that after all the craziness of the summer we really wanted to just lay low… but still, it feels good, and I’m hoping that we can keep that trend up for the next couple months…

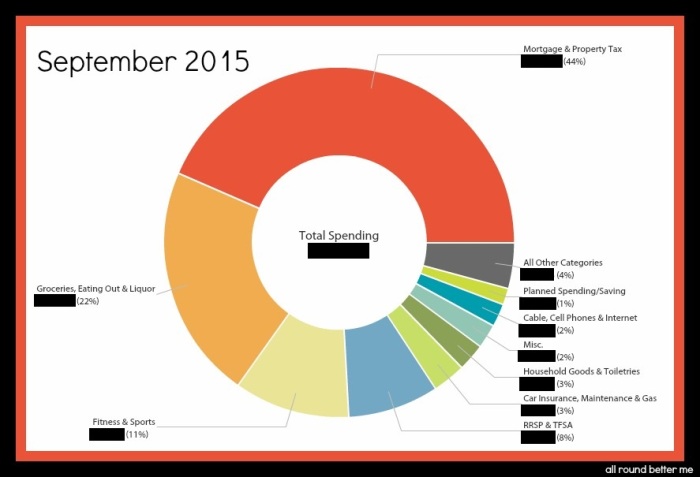

Anyway, let’s take a look at the break down of September’s spending.

This month the big categories were our mortgage (as usual), food & drink (also as usual), and fitness & sports. September is when both my husband and I pay for all our sports teams for the year, so we expect that expense and plan for it. So let’s see how the numbers came out…

Normally I go over each category individually, and I was thinking of changing it up… but I think I’m just going to keep with the normal routine on this… And just like last month, I made sure not to mess with any of the budget numbers, so we don’t have to go back to that post to check them… So, let’s start…

1. Mortgage: Predictable and normal. I’ve been budgeting a little extra in that category most months, so for October I was able to put a little less in and use up some of the “fund”.

2. Utilities & Home Insurance: Another boring category. Didn’t spend too much this month, but want to keep boosting up the funds for when the colder months require more heating. So far we haven’t had to turn on the heat, but I’m sure that will change pretty quick in October. The other part of this is saving up to pay for our home insurance in February.

3. RRSP & TFSA: In September, my husband increased his RRSP contribution, but it only took effect for the second payment, so we had a bit left over… October will be the full amount for both of us, so I filled it back up to match what it should be.

4. Planned Spending / Saving: After all the wedding expenses in August, I put most of what was left of my bonus in to the planned spending accounts., but the only expense here in September wasn’t budgeted for… I forgot that I needed to buy some stamps to mail out our thank you cards… the amount budgeted for this category in October is quite a bit less, and I expect most of it to be spent because my husband will be doing some traveling in October.

5. Life Insurance, Medical & Family Expenses: We managed to only have a couple expenses in this category this month, which is great because that means that the rainy day funds are filling up.

6. Cable, Cell Phones & Internet: This category is down a bit this month for expenses, and I’m hoping it will stay that way for a few more months because we changed service providers… so I decreased the amount budgeted for October… we will see how this new service works out…

7. Car Insurance, Maintenance & Gas: Both my husband and I rode our bikes to work a lot during the month of September, so our gas spending was way down. Yay! I don’t expect that trend to keep up with the weather probably turning colder and wetter… I’m also wanting to save up so we can get a dent repaired on my husband’s car… not sure how it happened, someone must have driven in to the car when I had it parked near my office… Yeah, the dent in my husband’s car happened while I was borrowing it… He was not impressed…

8. Groceries, Eating Out & Liquor: As I expected, September was a bit more spendy for food… I did do some stocking up on some things before I went away for work, so the expenses may have been a little inflated. Hopefully that means that October will be lower… I’m away for most of the month so I’m not going to be buying much myself or eating much at home, but am planning to host a turkey dinner on Thanksgiving (Canadian Thanksgiving is in October), so that might bring the grocery total up a bit. Hopefully my husband can keep his food expenses low while I am away…

9. Household Goods & Toiletries: Not much exciting here. Paid for our cleaner and some toilet paper and such… Oh, and my husband has been doing some random repairs around the house. I want to see if I can boost this up a little before Christmas so we can give our cleaner a nice Christmas bonus…

10. Fitness & Sports: As I mentioned already, September is when we pay for our sports leagues. I still have one payment left to make, but since I am away for work right now, I’m not sure when I’ll be able to get it submitted (not that I’m playing much this month anyway…) But I think I managed to estimate correctly. I didn’t budget anything in October for this because we should be covered for a few months with the September dues.

11. Clothing & Personal Care: A haircut for me, and my husband bought some razors… and a few other items I think… (I hope…) I’m going to need a couple new pieces of work clothes soon, so I’ll keep adding to the clothing “fund” so that I’ll able to get those items when I am home.

12. Misc.: September we had a few gifts to give and some charitable giving… but I really wanted to start saving for Christmas presents… Unfortunately, the numbers didn’t work to add too much to this category for October… Guess I’ll have to work on it in November or it will all come out in December… which wouldn’t be a very wise decision…

So there it is… another review and budget… I’m so happy about the results from September! Here’s hoping October stays low too.

How did your September go? Did you see the same decrease as I did after the summer craziness?

**Edit: I have decided that I don’t want to share my actual numbers on the blog, so I have removed them from this post… Sorry if it makes it a bit confusing or unreadable… Hopefully it isn’t unbearably so.

I too, saw a decrease in spending in September. I had a bit of a “spendy” August, so I was purposefully making sure I was uber frugal in September. Now I just need to stay on track during the challenging holiday season.

LikeLiked by 1 person

Yes, the holidays always add expenses. Even if we are being frugal and attempting to avoid the consumerism associated with them, there are always dinner parties and so many more “special” meals to splurge on.

LikeLiked by 1 person